Cpcu 500 Practice Exam Pdf

Course Summary: Learn the basics of risk management fundamentals.

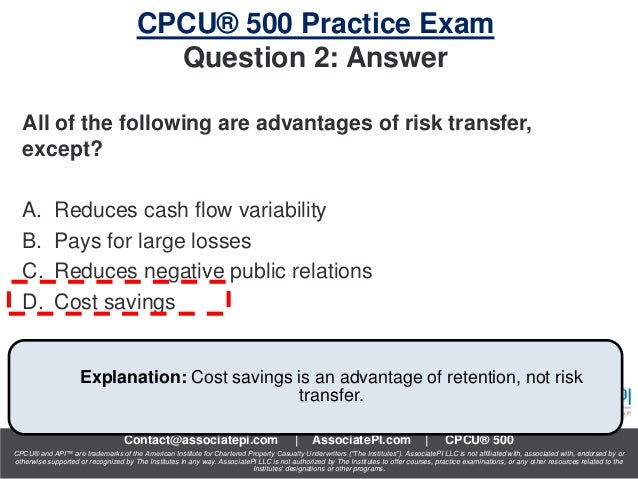

- Download your free CPCU® 500 practice exam at In our CPCU® 500 exam format video we detail the type of CPCU®.

- Pass the Practice Exams a few times: Leave at least at least 4 and preferably a full 7 days before the real test to take the online practice exams. Passing the exams will give you the confidence you need to take the exam without feeling rushed or unsure of your answers. The practice exams are very similar and sometimes harder than the actual.

- For more concept questions, download our free CPCU ® 500 practice exam. CPCU ® 500 Sample Exam Questions – Part B. David’s HO-3 policy contains a provision stating that he must insure his property to at least 80% of his property value in order to receive full insurance coverage in the event of a loss.

- Managing risk data

- Modeling outcomes

- Applying new risk technologies

What’s in Our CPCU 500 Study Guide Package

We’ve loaded our study materials e-bundle with tons of content to help you grasp all the tricky concepts:

Study Guide Outlines: The cornerstone of our review materials is our study guide outlines, which condense each chapter to several pages of key terms, major concepts, and other important lists of information. The clean outline format makes it easy to see how the details presented are related to each other.

Oct 01, 2020 cpcu 500 study guide Posted By Nora Roberts Public Library TEXT ID 720d9f9d Online PDF Ebook Epub Library or all of the cpcu be it the books study guides registrations etc the au tests are also great practice since they have a.

Basic Risk Measures Table: One topic you’ll learn about is how insurance companies measure risk. We provide a convenient table that shows each of the six measures, what they tell you, how each measure relates to risk, and helpful examples to help you understand what they refer to.

SWOT Analysis Chart: This printable shows you how a SWOT table is organized, with examples of what might fall in each quadrant.

Causal Factor Charting: Causal factor charting is a technique used to help you analyze what were the main causes of a loss occurring. This handout lists the steps for creating a chart and has a sample chart for your review.

Prouty Approach: The most appropriate way to deal with a risk depends on how often it happens and how severe the consequences would be. This table shows you the recommended risk treatment approach, based on those factors.

Meeting Risk Financing Goals: There are several options you could use to make sure you have the funds to cover losses, but not all of them are equal. This study aid shows what goals can be accomplished with each method.

Volatility Practice Problems: This course covers several formulas and calculations relating to volatility. Our study aid bundle includes sample problems and walk-throughs showing how to exactly how to apply those concepts.

Normal Distribution: Normal distribution is a tricky concept that is best learned through illustrative examples. We provide a clear, step-by-step method that makes it easy to solve any type of normal distribution problem.

Cpcu 500 Practice Test

Linear Regression Analysis: Risk professionals often use linear regression to predict what losses may occur or how severe they may be. Our sample problems show you exactly how to work through these types of word problems.

CPCU 500 Study Guide e-Bundle – Only $24.99

- For use with 1st edition course of CPCU 500: Managing Evolving Risks

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study Guide

- BONUS: Basic Risk Measures

- BONUS: SWOT Analysis

- BONUS: Causal Factor Charting

- BONUS: Prouty Approach

- BONUS: Meeting Risk Financing Goals

- BONUS: Volatility Practice Problems

- BONUS: Normal Distribution

- BONUS: Linear Regression Analysis

Update: CPCU® 500 has been updated to a newer edition, so the chapters are no longer broken up as outlined below. Our study materials have been updated to reflect the newer edition.

Most of the CPCU courses separate their chapters by topic, with each chapter covering a different subject area that doesn’t necessarily require you to know the information from previous chapters first. CPCU 500, however, is an exception to that rule. The logical progression isn’t obvious, but once you learn about it, it gives you a much better understanding of how the material in each of the chapters relate to one another, thus improving your comprehension.

CPCU 500 is all about risk management, or helping your insureds identify the exposures they face and helping them plan for potential losses. The course starts off with a general overview about what “risk” means, then each subsequent chapter moves on to the next logical question that arises until the connection between risk and insurance is finally made. Here is a list that shows the progression of the chapters:

1) Overview of Risk Management

What is risk and what are some basic ideas behind managing it?

2) Identifying Loss Exposures

What are the main categories of loss exposures you could face & how do you go about identifying them?

3) Analyzing Loss Exposures

How to do prioritize what exposures need your attention & choosing the general strategy for managing them?

4) Selecting Risk Control Techniques

How do you avoid or mitigate the potential losses that could occur?

5) Selecting Risk Financing Techniques

How do you pay for the losses that can’t be avoided?

6) Data Analytics

What role does technology play in risk management?

7) Insurance Policy Fundamentals

What losses can you insure & how are policies created to provide protection?

8) Common Features of Insurance Policies

How are insurance policies applied to actual claims?

Hopefully you’ll find that knowing the progression of the chapters gives you an overall context that better helps you organize and remember the information you are learning!

Build a strong foundation in CPCU 500!

For more help with CPCU 500, check out our latest study guide and free bonus materials!

CPCU 500 Study Guide e-Bundle – Only $24.99

Cpcu 500 Exam Fee

- For use with 1st edition course of CPCU 500: Managing Evolving Risks

- Delivered by email as downloadable PDF

- For buyer's personal use only (non-transferrable and not for resale)

- Includes:

- Study Guide

- BONUS: Basic Risk Measures

- BONUS: SWOT Analysis

- BONUS: Causal Factor Charting

- BONUS: Prouty Approach

- BONUS: Meeting Risk Financing Goals

- BONUS: Volatility Practice Problems

- BONUS: Normal Distribution

- BONUS: Linear Regression Analysis